Note 4 Do not deduct income tax if you estimate that the total fee paid in the year is less than the total claim amount on Form TD1. Level 16 Menara LGB 1 Jalan Wan.

Foreign Companies Expat Tax Professionals

The employee benefits provided by company below is tax deductible.

. The ATO has advised that directors fees accrued in one financial year will only be deductible in that financial year if they are paid out and assessed to the directors in the. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967. Given 1 Kena Tax.

Are directors fees tax deductible. Starting from YA 2020. Real Story of Deemed Income Provision under S29 4 of the Income Tax Act.

The individual as a contracted director providing an expert opinion and charging fees to the company would need to charge an additional 6 service tax for the consultancy. Directors fees approved in arrears. Is directors medical expense tax-deductible in Malaysia.

Under this provision taxpayers can deduct an accrued expense if the first two items above have been met and the economic performance depending on the expense. THK Management Advisory Sdn Bhd - Johor - Accrued Directors Fees Tax Treatment Malaysia. 41 Generally legal or professional expenses are deductible where these are incurred in the maintenance of trade rights or trade facilities existing or alleged to exist and are not.

Maximum tax agent fee deductible amount. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967. Parking allowance petrol allowance meal allowance medical benefit child care benefit.

It mean the directors must declare hisher director fee in personal tax in the following year. Note 5 The issue of. Know The Transaction Costs And Taxes When.

Is directors medical expense tax-deductible in Malaysia. If fees were accrued in June 2013 the. Maximum secretary fee tax agent fee deductible amount.

The company voted and approved directors fee of 20000 on 30 Jun 2020 to be paid to you for your service rendered for the accounting year. Directors Remuneration and Tax Planning- Evidence from Malaysia. KTP Company PLT AF1308 LLP0002159-LCA Can directors medical fee tax deductible in Sdn Bhd.

The common interpretation is that the company has until the 30 th of September of the following income year to pay the directors fees ie. Directors Remuneration and Tax Planning- Evidence from Malaysia. 21 An individual is assessable to tax on his directors fees or bonuses from employment when he becomes entitled to receive those fees or bonuses.

Directors Remuneration and Tax Planning- Evidence from Malaysia. Given 3 Kena Tax Sdn Bhd never pay PCB on the accrued director fee. KTP Company PLT AF1308.

By Thursday 12 January 2017.

Do You Know How To Withhold Tax From Directors Fees Tax Alert August 2017 Deloitte New Zealand

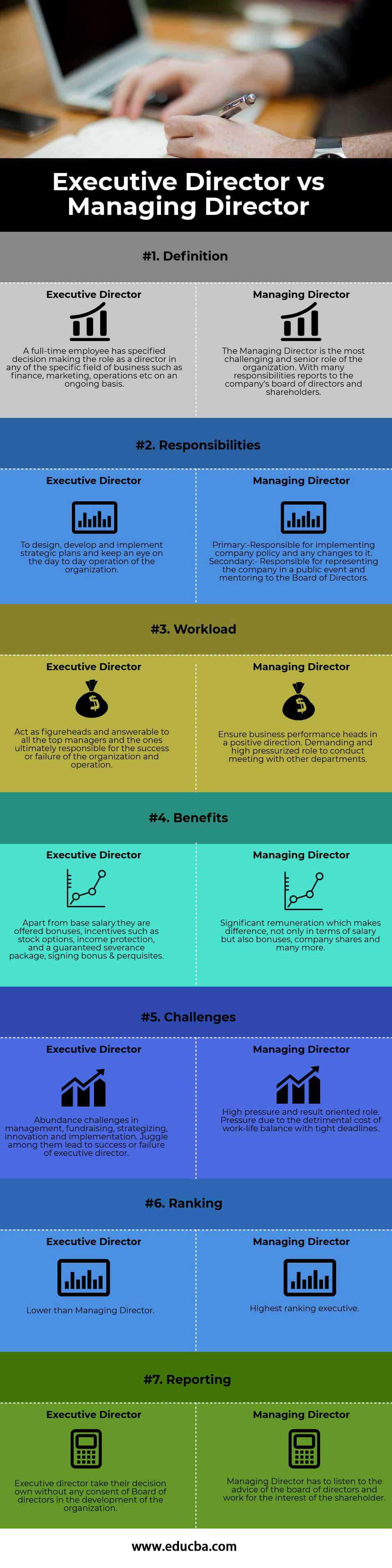

Executive Director Vs Managing Director Top 7 Differences To Learn

Accrued Director Fee And Tax Treatment

Taking Dividends Vs Salary What S Better Starling Bank

Randy Leclair Cfa Director Capital Markets City Of Toronto Linkedin

Can Directors Be Held Liable For Business Debts In A Limited Company

Accrued Directors Fees Tax Treatment Malaysia Jan 06 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Debt Warehousing Restrictions For Directors And Employees

Palladium Holdings Pty Ltd Certain Tender Offers Business Combinations And Rights Offerings In Which The Subject Company Is A Foreign Private Issuer Of Which Less Than 10 Of Its Securities Are Held

Disheartened Director Of Bureau Of Prisons Calls On Staff To Out Corruption

Directors Fees Ato Everything You Need To Know Pop Business

How To Legally Take Money Out Of A Limited Company Company Debt

Important Considerations When Paying Management Fees Bdo Canada

Salary Or Dividends How Directors Get Paid Can Impact Their Business Business Rescue Expert

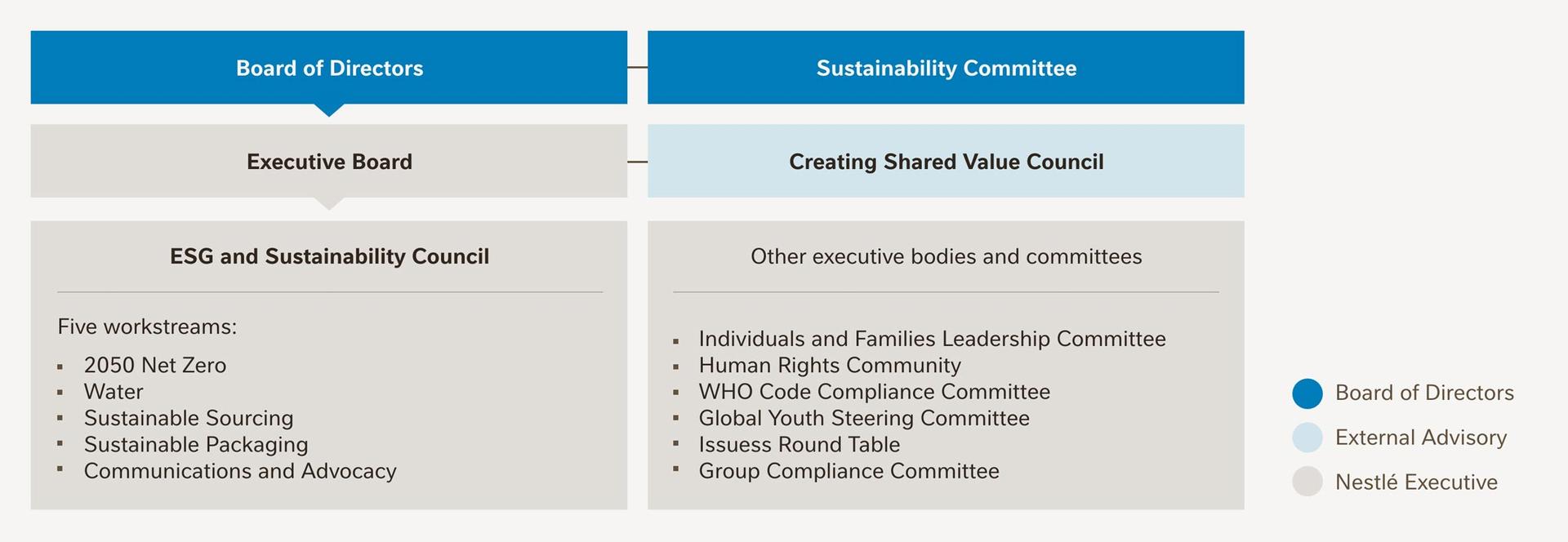

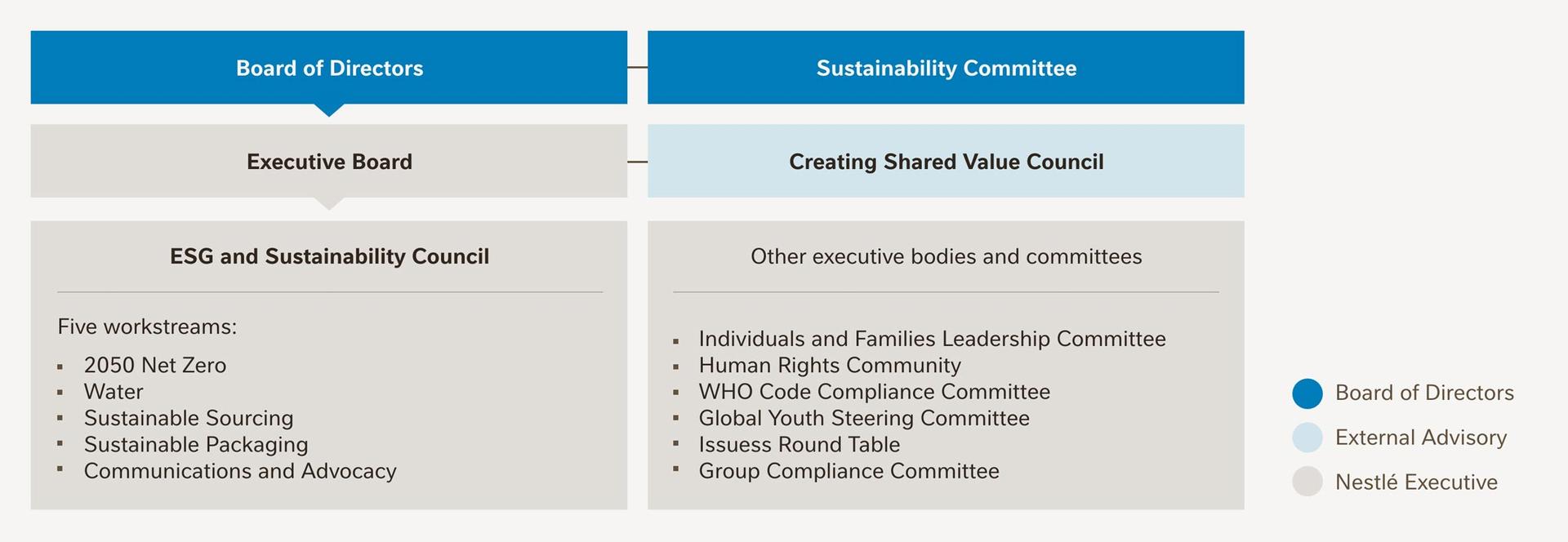

Sustainability Governance Nestle Global